NIS America has released a brand new trailer for The Legend of Heroes: Trails through Daybreak II. Trails through Daybreak II is scheduled to launch for Nintendo Switch, PS4, PS5 and PC on February 14th, 2025. The press release states that this new trailer specifically refreshes fans on the complete events of the first Trails through Daybreak game. So if you haven’t played the first title yet, or you haven’t yet finished it, you might want to hold off on watching the trailer below. Also down below, you’ll find a little bit about the game from the latest press release.

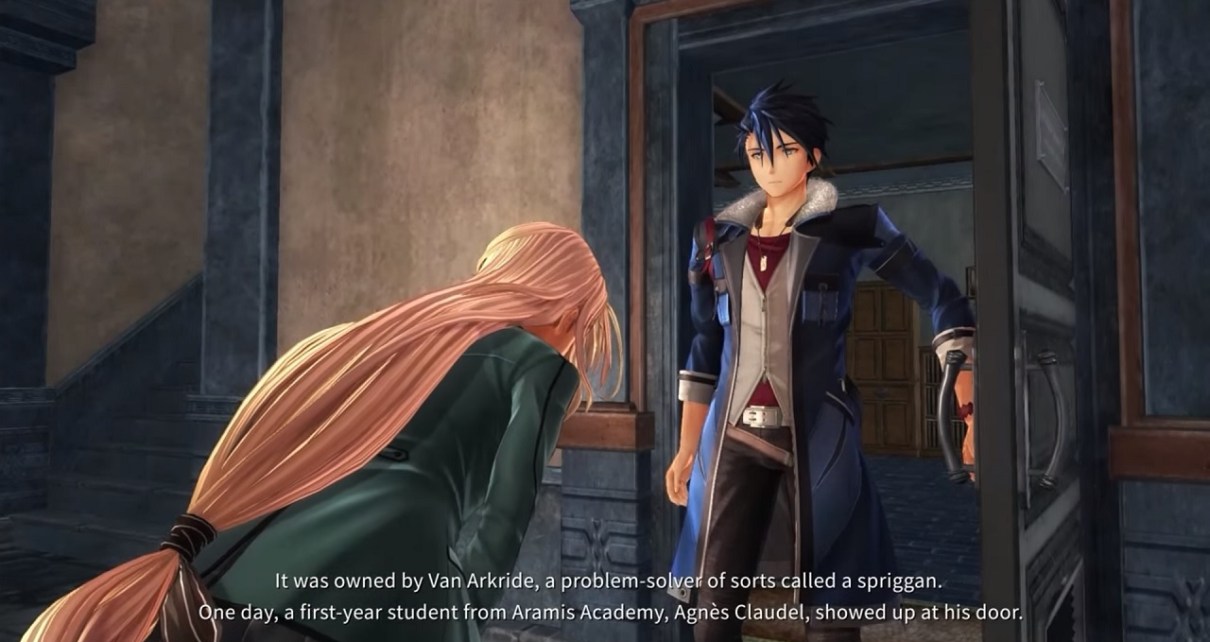

About The Legend of Heroes: Trails through Daybreak IINo longer threatened by the mafia organization Almata, the people of Calvard have returned to their peaceful lives. But one day, a shocking series of murders involving a mysterious crimson beast sets the wheels of fate in motion once again. Various factions spring into action – both those who abide by the law to uncover the truth and those looking to capitalize on any new developments wherever possible, no matter how sinister. With chaos once again looming on the horizon, the spriggan Van Arkride receives an unexpected visitor, prompting his own investigation.

Who is behind the murders, and what is their goal? The sands of time bring old and new faces together for this thrilling second installment in the Trails through Daybreak saga.